One issue I have been touching on lately is the extremely low P/E ratios of equities in the 1970s. From a discounted cash flow perspective, equity values are a product of current earnings, earnings growth expectations, and the discount applied to those earnings. These low valuations appear to have been related mostly to low growth expectations. But, I don't see an obvious reason in the data why growth expectations would have been low. (The mood of the time certainly conveyed low expectations, however.)

The effect of such high inflation on de facto tax rates could explain some decline in expected earnings growth, since firms would expect to be paying future taxes on what would amount to inflated return of invested cash. But, I think this only explains a small portion of the unusual valuations.

I wonder if some of the dislocation of the time could be related to inflation in another way. I find the debate over public deficits to be a little bit unsatisfying. To me, when all is said and done, the main question at any point in the business cycle regarding public spending is, "Is it useful?" I don't see much difference between tax-supported expenditures and bond-supported expenditures. In either case, cash is being taken from the private economy and applied to some public expenditure. In the case of the bond, I think this is most clearly thought of as a combination of two transactions. The first transaction is the equivalent of a tax. Cash (representing use of scarce resources) is transferred from private investment to a public expenditure. The bond represents a promise of a future transfer. If the government defaults on the bond, then we are left with just the tax, and the transfer is cancelled.

In the case of an inflationary policy, the bonds are paid back with devalued dollars, so it is, in effect, a partial default. So, compared to the original set of promises, in the inflationary scenario the government is engaging in public consumption, investment, or transfers with funds that had been earmarked for capital repayment. This could represent a significant negative shock to the capital base. In effect, the government had pre-committed to re-injecting cash into capital markets, but ended up only injecting a portion of that capital into those markets.

A 20 year bond purchased in 1965 would have only received about 60% of its expected value back in real terms.

Since the inflationary policies of the late 1960s and 1970s reduced the expected commitment of repayment, they were like a one-time tax on capital. It would take a lot of work to figure out treasury holdings by duration, inflation expectations, etc., to come up with a good estimate of the total, so I'm not sure I will get past the theoretical here.

|

| Source |

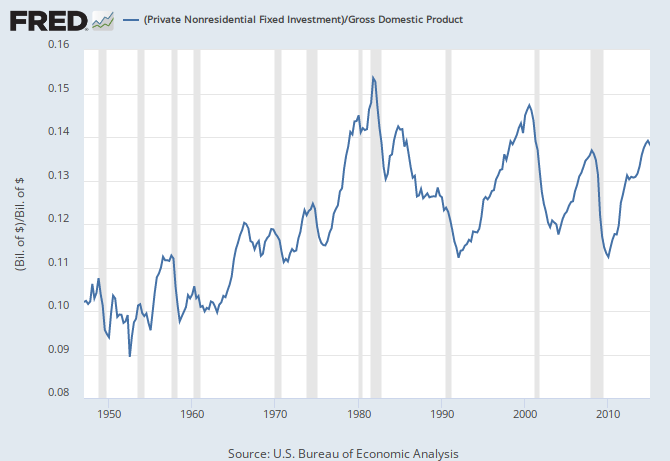

But, on the other hand, private fixed investment was relatively high in late 1970s. I don't have an explanation for that.

|

| Source |

But, the tax burden of high inflation could not be passed on. The terms of nominal repayment had been set by bondholders when the bonds were purchased. This was a case where capital could be taxed without the ability to pass the cost on. It seems plausible that this could be a significant factor in the high capital income levels of the time, relative to valuations. There was simply a dearth of capital to re-invest. And, this coincides with a period of low GDP growth per worker.

But, the tax burden of high inflation could not be passed on. The terms of nominal repayment had been set by bondholders when the bonds were purchased. This was a case where capital could be taxed without the ability to pass the cost on. It seems plausible that this could be a significant factor in the high capital income levels of the time, relative to valuations. There was simply a dearth of capital to re-invest. And, this coincides with a period of low GDP growth per worker.And, I suppose the opposite effect happened 20 years later when persistently lower inflation led to excess gains for treasury bond holders, and there was a period of unusual growth expectations.

|

| Source |

It is interesting that the positive (negative) inflation shock was associated with low (high) growth expectations, low (high) real interest rates, and high (low) equity risk premiums. It might have been reasonable to expect real interest rates to increase in the high inflation 70s. There was a real income shock in the low risk, fixed income market. So, we might have expected to see capital pulled from risky investments like corporate equity, to rebalance portfolios, but not completely, because of frictions in asset allocation adjustments. This would leave bond and real estate prices low (real yields high). But, the rebalancing included an over-correction, so in the 1970s, portfolios included less equity and more fixed income. Albeit, rebalancing that went into housing did provide an inflation hedge that would have had value at the time.

It is interesting that the positive (negative) inflation shock was associated with low (high) growth expectations, low (high) real interest rates, and high (low) equity risk premiums. It might have been reasonable to expect real interest rates to increase in the high inflation 70s. There was a real income shock in the low risk, fixed income market. So, we might have expected to see capital pulled from risky investments like corporate equity, to rebalance portfolios, but not completely, because of frictions in asset allocation adjustments. This would leave bond and real estate prices low (real yields high). But, the rebalancing included an over-correction, so in the 1970s, portfolios included less equity and more fixed income. Albeit, rebalancing that went into housing did provide an inflation hedge that would have had value at the time.

The opposite happened in the 1990s, where the fixed income windfall didn't lead to an excess of fixed income investment. Real interest rates were high and housing price/rent ratios were low in the 1990s. Not only did some of those gains go into investments with cash flow risk; apparently all of the gains and more went into investments with cash flow risk.

And, given this over-rebalancing, we might expect that total required returns on corporate capital (the risk free rate plus the equity premium) would have gone up during the 1970s (down during the 1990s), as the dearth (excess) of risk-seeking capital would have bid down (up) corporate assets. We do see valuations move down (up) relative to earnings, but the change in valuations appears to be explained by changing growth expectations, not changing total expected returns.

Maybe, thinking in terms of low risk interest rates as a sort of discount from a relatively stable at-risk required rate of return, there is a sort of market segmentation, and there is a relatively inelastic demand for a set amount of low risk real income. When the relative rate of low risk income declines, this segment of the market has to swap more capital with the risk-taking segment in order to maintain its level of income.

Maybe the transfer of capital from private markets to public expenditures, either through the inflationary fixed income shock or through changes in relative Federal spending levels, change growth expectations, and this is what causes valuations to fluctuate through growth expectations instead of through at-risk return requirements.

As usual, please post references in the comments if you know of good literature on this idea.

No comments:

Post a Comment